What is the ideal auto insurance coverage business in The golden state? Based on our study, Geico, Progressive, State Farm and also Wawanesa are among the finest auto insurance policy companies in The golden state.

vehicle vehicle car vehicle

vehicle vehicle car vehicle

These are example rates and should only be used for comparative objectives. Rates were calculated by examining our base profile with the ages 18-60 (base: 40 years) applied. liability. Depending upon age, drivers may be an occupant or home owner. For teenagers, rates were identified by including a 16- or 17-year-old teen to a 40-year-old couple's plan.

Prices were computed by assessing our base profile with the following occurrences used: tidy record (base), at-fault mishap, solitary speeding ticket, solitary DUI conviction and gap in insurance coverage (insurance).

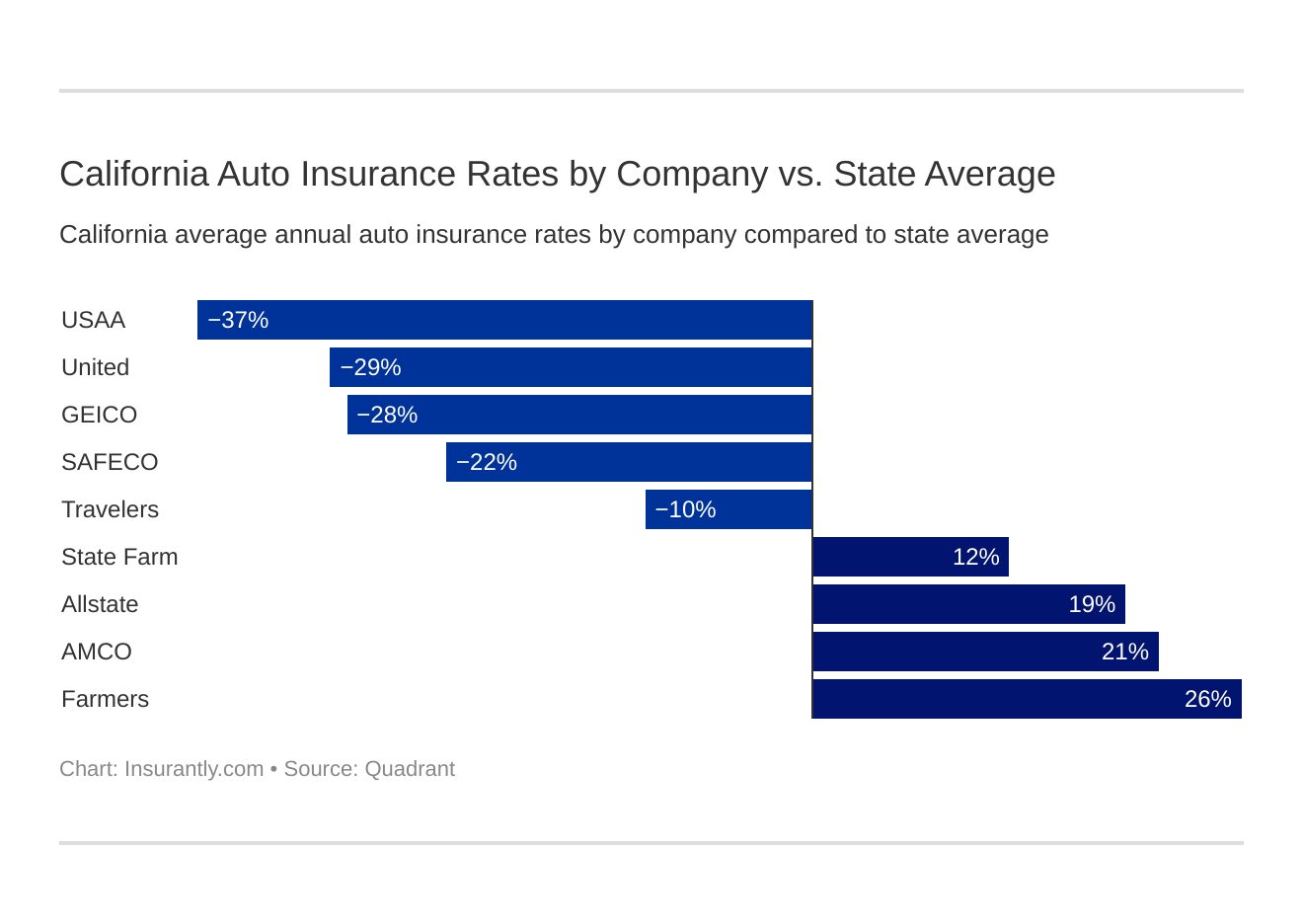

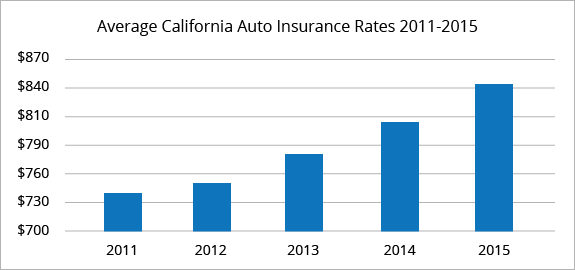

According to the Insurance Info Institute, the average California vehicle driver pays about $1,034 a year for cars and truck insurance coverage. That makes The golden state the 19th most inexpensive state for vehicle insurance coverage in the united state. But that doesn't mean you can not conserve much more money on your car insurance coverage policy. Read on to locate the ideal cars and truck insurance policy for you, your auto, and also most significantly, your budget plan.

How To Put The Brakes On Rising Car Insurance Costs - Wndu Fundamentals Explained

In the sections listed below, we have actually examined countless quotes and also broken down the best auto insurance coverage rates for all various sorts of The golden state chauffeurs. cheaper car. Young or old, excellent vehicle driver or erratic document, Nor, Cal or two, Cal, we have actually got the very best prices for you. Continue reading to discover just how to conserve some lots of money on your following cars and truck insurance coverage.

liability car insured car insurance cheapest

liability car insured car insurance cheapest

Just since these companies use the cheapest typical prices for teen drivers, it does not imply they'll be the most affordable for you or your child (auto).

When comparing cars and truck insurance rates for teens as well as young chauffeurs, you may be shocked to find that both groups will certainly pay the very same amount with Hugo Insurer $65/mo. That's where the similarities end. Teen motorists can see rates as high as $223/mo (Bridge, Web), while the highest possible typical young drivers can expect to pay is $132/mo (Safe Automobile).

Big distinction, right? While these are the most economical companies usually, you still desire to contrast rates to see which company will give the best rates for you based upon your background, demographics, and various other factors. accident. Be certain to contrast quotes More helpful hints from various insurance coverage companies to ensure you obtain the most budget-friendly premium (cheaper auto insurance).

The smart Trick of Infinity Insurance: Insurance Quotes For Auto, Business, Home ... That Nobody is Talking About

auto cheapest auto insurance cheaper auto insurance insured car

auto cheapest auto insurance cheaper auto insurance insured car

These are a few of the lowest rates for retired drivers generally, however make sure to still look around to compare automobile insurance coverage prices amongst different companies and also consider the discounts you may be eligible for to further lower your regular monthly costs - dui. Most Affordable CA Companies for Married Drivers Love apart, marriage features several advantages one being a decrease in automobile insurance policy rates.

As you can see, the month-to-month insurance coverage prices double from Hugo at $41/mo to Foremost at $81/mo. So also within this list of one of the most economical insurance coverage carriers, you intend to be sure you choose the company that will best suit your budget without sacrificing high quality insurance coverage. Cheapest Quotes for Single Drivers Even If you have not made it down the aisle does not mean you have to pay too much for automobile insurance policy.

While a wedded vehicle driver guaranteed by Workmen's will pay a regular monthly costs of $74, a solitary chauffeur will certainly be stuck paying $87/mo (insured car). This $13 distinction might not appear like a lot, however it can swiftly include up. In a year, you might pay over $150 even more in cars and truck insurance coverage costs. Given that your insurance coverage rates have a tendency to be a bit greater as a solitary motorist in The golden state compared to a wedded motorist, make sure to check for price cuts that will certainly assist lower your monthly insurance policy costs. affordable.

cheap car cheaper car insurance laws suvs

cheap car cheaper car insurance laws suvs

While the differences are slight, you'll see higher rates for males within the exact same insurance firm. Women insured by Metromile will certainly delight in rates of $61/mo, while males will need to pay a bit a lot more at $64/mo (cheapest). Sex apart, there is a slew of elements that impact the rate an insurance coverage firm estimates you, so make certain to compare the insurance policy prices. low cost.

What Does Cheapest Car Insurance California 2022 - Marketwatch Mean?

These are enormous jumps in insurance coverage rates that can make a big effect on your monthly budget plan. auto insurance. When contrasting the prices of complete coverage insurance to the state minimum in The golden state, you'll find that complete insurance coverage is more costly usually (laws). Let's claim you choose to buy state minimum insurance from Flexibility - cheaper car.

credit suvs cheap insurance cheapest car insurance

credit suvs cheap insurance cheapest car insurance

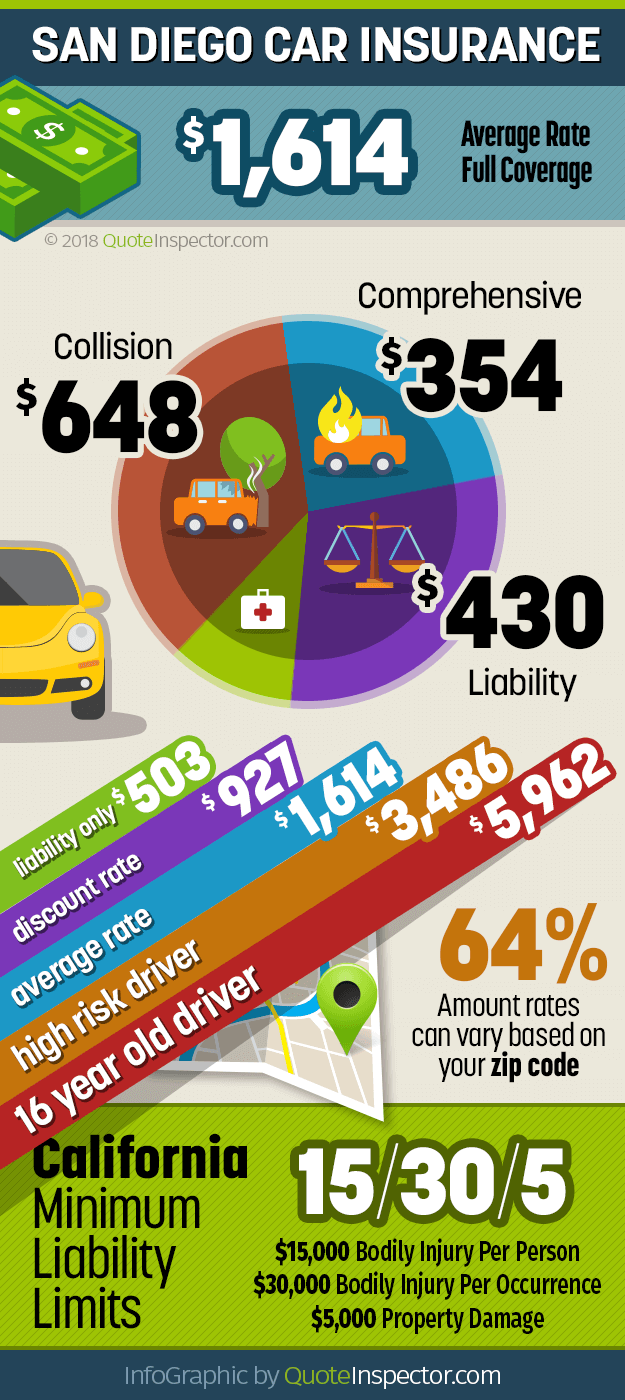

However, if you determine that you prefer to have full protection insurance policy with Flexibility, you'll pay over $90 more at $134/mo! When looking at complete coverage car insurance coverage, be certain to contrast rates to discover the most budget friendly choices for you. insurance affordable. A Lot Of Economical Insurance Coverage for Chauffeurs in California's Significant Metropolitan Locations Depending on where you reside in California, the vehicle insurance business that can offer one of the most economical rates will certainly differ.

Least Expensive Auto Insurance Coverage for California Suburbs As you head out of the major cities to the suburban areas like San Bernardino Area, automobile insurance rates as well as the most effective firm to select for cost effective insurance differs a little bit, but remains rather regular. Right here are the most effective companies to pick from for budget-friendly obligation insurance coverage in the California suburbs.

Geico provides the most budget-friendly rate at just $21/mo adhered to by Progressive at $24/mo. American P&C ($26/mo), Mercury ($27/mo), and Infinity ($27/mo) deal similar rates as they round out the most inexpensive cars and truck insurance coverage service providers in country California. The Very Best The Golden State Auto Insurance Coverage Discounts One of the ideal ways to lower your auto insurance policy rate is to benefit from discounts offered by the insurance provider.